If you’re not in the best of positions with regards to your credit rating, you’re probably nervously keeping an eye on the rising interest rates. While planning to refinance, undoubtedly the going will be tougher if your credit is just average but it’s not a completely hopeless situation.

How Bad Credit Affects Your Mortgage Refinance

Following are some helpful tips on how to proceed even when your credit report is not blemish-free.

-

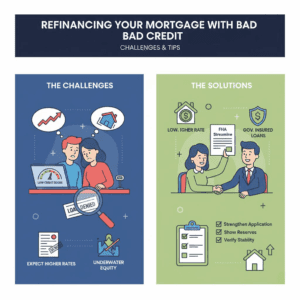

Expect Higher Interest Rates with Bad Credit

Even if you see mortgage advertisements on various channels which offer really great rates of interest – almost rock-bottom such as 3 to 4 percent, don’t bank on it. If your credit isn’t perfect, you’re not likely to actually get very low rates, no matter what the ads say. Mortgages at these rates are for pristine borrowers only.

Overcoming Common Refinancing Challenges

With a shaky credit rating, you can plan to refinance, but definitely not at the best rates in the market.

-

The Role of Equity in Your Mortgage Refinance

In the present environment, lenders are generally unwilling to refinance an existing mortgage if your property is underwater and its worth is less than what you owe. Even if you’re not actually underwater, some banks refuse to refinance when you have only have a small amount of equity in your home. This is because the new loan amount is calculated keeping your property’s present market value in mind.

Some conservative lenders might want 25 to 30 per cent equity before they agree to refinance

-

Government Insured Loans: A Way Around Equity Issues

You can circumvent the problems posed by inadequate equity and still manage to get refinanced. Even though conventional lenders insist on high equity in property, the scenario is slightly different with banks that offer government-backed loans. An FHA loan which is insured by institutions like the Department of Housing and Urban Development (HUD) is one such example.

With an FHA loan, even with a small amount of equity, it’s possible to get a mortgage with a loan-to-value limit of 97.75 percent.

-

FHA Streamline Refinancing for Existing Borrowers

If you have an existing FHA loan, it’s worthwhile to seek an FHA streamline refinance, a special type of mortgage product which is reserved for existing FHA borrowers. Loan applicants not appearing as ideal borrowers for some reason or the other can reap the benefits offered by this type of refinance.

Firstly, FHA streamline refinancing doesn’t require appraisals. So you can qualify for such loans even if your property is underwater or you do not have any equity. Borrowers can more easily qualify for such loans because they are not made to verify job, credit, or income.

-

Make Your Application Look More Attractive

Along with bad credit, if the rest of your loan application packet is questionable, you might be in trouble. Make an effort to offset bad credit by giving a pristine look to the rest of the mortgage application, especially in case of a conventional loan. If you can show proof of savings with cash reserves in your bank account, your loan application will appear more attractive.

-

Strengthen Your Job & Income Documentation

Get your job paperwork (like pay stubs and W-2 statements) in order and make income documents properly. If you’ve been employed for an extended period, emphasize the time length you’ve worked. If you’re expecting a raise in the near future, try to get a letter from your employers stating this. This will assure the lender of job stability.